The last time I checked, Safaricom shares were trading at Ksh 36.15, though the average rate has been higher than that for the past year. With such a good return on investment, you probably want to learn how to buy Safaricom shares.

Well, you can buy Safaricom shares online or through a stockbroker and pay in cash, through bank transfer, via MPESA, or using Bonga points. But before anything, you’ll need a virtual account known as a Central Depository and Settlement (CDSC) account.

I’ll explore all these methods to enable you to buy Safaricom shares most straightforwardly. I’ll also explain the Safaricom shareholders’ hierarchy to help you determine if the shares are worth buying.

And lastly, we’ll talk about the eligibility requirements to help you know if you qualify as an investor.

Here we go!

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

How to Buy Safaricom Shares Today.

Generally, Safaricom allows you to buy its shares online through a verified stockbroker. If you choose to buy them online, you can pay via MPESA, pay bill, or Bonga points.

But if you choose to do it via a stockbroker, then you’ll pay in cash or bank transfer. Note, nonetheless, that you first need to open a virtual Central Depository and Settlement (CDSC) account, which you’ll use to buy Safaricom shares.

Let’s talk about how you can open a CDSC account first.

How to Open A CDSC Account?

Generally, you can open a CDSC account in Kenya using any of these two options:

Option 1: The Bank

Provided your bank offers stock brokerage services, you can visit them and request to open a CDSC account.

You’ll, however, need to submit these requirements:

- Two recent passport photos

- Valid Kenyan ID or passport

- Bank statement or utility bill

- Original Certificate of Incorporation (for group shareholders)

Once you submit the above, you’ll receive a CDS1 form to fill out before receiving the CDSC number.

Option2: Shares-Trading App

Using a shares-trading app like AIB Digi Trader App, you can sign up for your CDSC account, view your trading statements, monitor the Nairobi Stock Exchange (NSE) prices, and trade in real-time.

So, this mobile app is worth having if you plan to buy and sell Safaricom shares online. The best part is that you can use it to trade in other stocks at the NSE and not just Safaricom shares.

Option 3: USSD

You can also use the USSD code *543# to sign up for a CDSC account. You’ll receive login details to your online account once you complete the USSD signup.

How to Buy Shares at Safaricom Using a Stockbroker?

Now that you have your CDSC trading account, you can choose to buy shares through a verified stockbroker. You’ll need to pay in cash or via bank transfer if you select this route.

Here’s how to go about it:

- Deposit money into your CDSC online account using the Pay bill number that the broker will provide.

- Alternatively, you can transfer from your bank account

- Go ahead and place your order by filling out the order form that the stockbroker provides

- Wait for the shares to reflect in your CDSC account within 48 hours

Remember, the minimum number of shares you can buy is 100.

How to Buy Safaricom Shares Online

You can purchase Safaricom online using MPESA pay bill number, bank account, or Bonga points.

a. How to Buy Safaricom Shares Via MPESA

Follow these steps to buy Safaricom shares using MPESA:

- Go to Lipa Na MPESA on your phone

- Opt for pay bill and use the pay bill number 163163

- Enter your name or the name of your group as the account number

- Follow the ensuing steps to complete the purchase

b. How to Buy Safaricom Shares Through Bank

Currently, Safaricom allows you to buy its shares via Cooperative Bank. You’ll need to pay through the account number 01120150100700 under the account name Safaricom Investment Cooperative (SIC), Westlands branch.

c. How to Buy Safaricom Shares Using Bonga Points

When purchasing Safaricom shares using Bonga Points, you can do it via USSD or MySafaricom App.

The USSD Option

Here, you’ll need to:

- Dial *126# on your mobile

- Choose Lipa Na Bonga Points

- Opt for pay bill

- Enter your broker’s pay bill number

- Enter your CDSC account number under the account number section

- Input the amount of money you want to deposit directly into your CDSC trading account

- Log into your CDSC account to directly buy the shares you want

The MySafaricom App Option

You can also use Bonga points to buy Safaricom shares using MySafaricom App.

Here are the steps to follow:

- Download MySafaricom App on your mobile phone

- Launch the app and use your mobile number to receive a one-time password (OTP) via SMS

- Use the OPT to log into your account

- Select Bonga on the app

- Pick Lipa Na Bonga Points

- Choose pay bill number and enter your broker’s pay bill number

- Use your CDSC account number under the account number section

- Specify the amount you want to credit into your CDSC account

- Input your PIN and continue with the subsequent steps

N/B: For every 5 Bonga points, you redeem 1Ksh, which you can use to buy Safaricom shares.

Who Qualifies for Safaricom Shares

Safaricom allows both individuals and groups to buy its shares. The requirements for the two sets of shareholders, however, differ.

Eligibility Requirements for Individuals

Individual shareholders need to:

- Buy at least 500 shares (check the current Safaricom share prices here as they keep changing)

- Pay a registration amount of Ksh 10,000 (non-refundable)

- Be willing to pay a monthly contribution of Ksh 3,000

- Submit your passport, ID copy, KRA PIN certificate, and proof of payment

Eligibility Requirements for Groups

Chamas, SACCOs, and self-help groups can also buy Safaricom shares if they meet these requirements:

- Be a registered group

- Pay a registration amount of Ksh 25,000

- Buy a minimum of 1,500 shares

- Be willing to contribute Ksh 15,000 monthly

How Much Is Safaricom Shares?

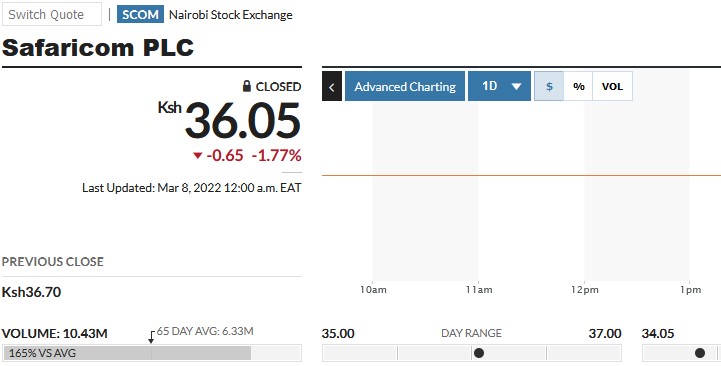

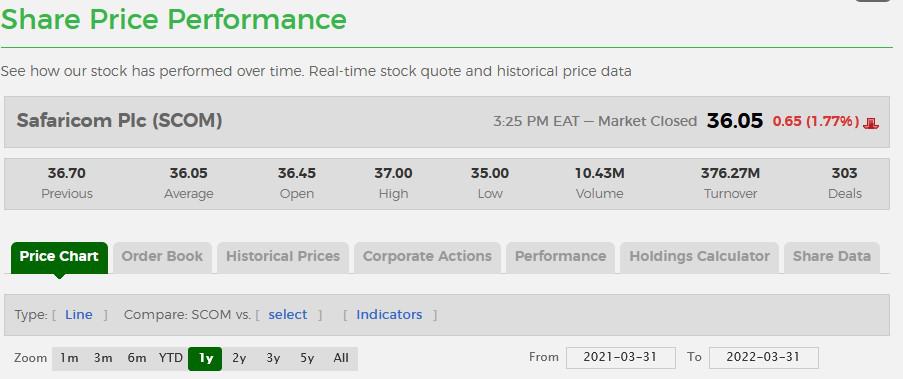

Safaricom shares prices keep changing every day. For example, on March 2nd, 2022, the price per share was Ksh 36.15. But if you go back to August 18th, 2021, when the prices hit the highest over the past year, shares were selling at Ksh 44.20.

However, the lowest price for the past year was on February 24th, 2022, and it was Ksh 34.55 per share. So, if we can use these prices as the benchmark, we can estimate that Safaricom shares go from Ksh 34.55 to Ksh 44.20.

But again, the prices are subject to change depending on the current market forces.

You can also visit Market Watch to see Nairobi Stock Exchange Safaricom Shares prices in real-time. When creating this post, the rate per share was Ksh 36.70.

Who Owns Safaricom? (Understanding The Safaricom Shareholder Structure)

The Safaricom shareholder structure often change, and currently, here are the entities that own Safaricom:

- Kenyan Government (35% shares)

- Vodacom (35% shares)

- Free-float (25% shares)

- Vodafone (5% shares)

You are probably asking, ‘where do I fall in that?’ The answer is free-float (public shares)—the members of the public own free-float shares.

How to Invest in Safaricom Shares

As a new Safaricom shareholder, you’ve to decide what to do with your shares. Will you sell or hold? Often, the decision depends on the market.

You can hold your shares for as long as you want if the prices are not reasonable, hopeful that they’ll favor you at some point. You can also sell and invest your money in something similar.

Overall, it’s essential to properly analyze the market and consult the right stock expert to make the right decision.

Remember, both profits and losses are shared among shareholders. So, you’ll only make good returns when Safaricom is making profits and not counting losses.

Let’s now talk about how you can sell your shares.

How to Sell Safaricom Shares in Kenya

Depending on how favorable the market prices are or your needs, you can sell your Safaricom shares anytime. Here’s how to go about it:

- Check the current Safaricom shares prices to see how much you’ll be selling at

- Talk to your broker about your plan to sell your shares

- Wait for someone to buy your shares, and you’ll receive the money in your account

People Also Ask

1. What Is the Current Safaricom Share Price?

When creating this post, the Safaricom share price was Ksh 36.70 per share. But overall, the price range for the past year has been between Ksh 34.55 and Ksh 44.20.

2. How Do I Buy Safaricom Shares?

You can buy Safaricom shares through a stockbroker or online and get to pay using Bonga points, cash, or MPESA. But before anything, you’ll need a CDSC (Central Depository and Settlement) account, which you’ll use to trade-in.

3. How Much Is 1 Share of Safaricom?

1 Safaricom share was going for Ksh 36.70 when creating this post (March 8th, 2022). The prices, however, vary from time to time, depending on market forces.

4. How Much Does It Cost to Buy Safaricom Shares?

Safaricom shares prices keep fluctuating, but you can expect to spend Ksh 34.55 – Ksh 44.20 per share as it has been so over the past year. However, you’ll need to buy a minimum of 500 shares if you are an individual or 1500 shares if you are a group.

5 How Do I Buy Safaricom Secondary Shares Through MPESA?

You can buy Safaricom secondary shares through MPESA using pay bill number 163163. You’ll then need to use your name or the name of your group as your account number and then follow the subsequent steps.

6. Is The Safaricom Share Price Worthwhile?

Safaricom is one of the biggest companies in Kenya and among the largest telecommunication brands in the world. So, though they often fluctuate, Safaricom shares are worth holding as their return on investment is sound. You just need to know when to sell and invest your earnings wisely.

Also Read:

Closing Remarks

Now you know how to buy Safaricom shares in Kenya. You can do it online or through a verified stockbroker and get to pay in cash, via MPESA, through the bank, or using Bonga points. Indeed, there is much flexibility when purchasing the shares, and the eligibility requirements are less strict.