In Kenya today, every citizen who’s above 18 years and has a KRA Pin, must file tax returns each year, regardless if you are employed or not. The good news is that the procedure on how to file KRA returns is not as complicated as most people perceive it.

Once you access the KRA iTax Portal online, you will be able to do this task from the comfort of your chair and computer. Without a single step to go physically to the KRA offices.

It’s important to file your tax returns early enough to avoid being slapped with a hefty KSh. 20,000 late filing penalty by the taxman. Remember this is Law that was enacted since 2015 and you don’t want to be caught on the wrong side of things.

In this article, I will guide you meticulously on how to file tax returns on iTax Kenya.

How to File Nil Income Tax Return Online for Individual in Kenya.

It is possible that you submit Nil Return if you don’t have a taxable income i.e. if you are not employed. Or if your income is below the minimum taxable threshold.

So all students fall perhaps can be grouped in this category.

Here is the procedure:

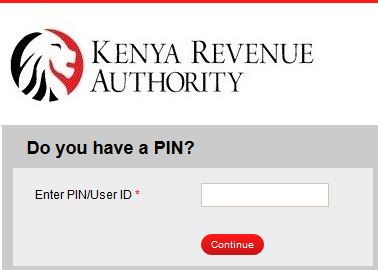

- Go to the iTax site on itax.kra.go.ke

- Log into the KRA iTax portal using your KRA pin and password.

- You will be required to calculate and key in a Security Stamp. This is often a simple arithmetic calculation right below the password e.g 24+16 =?

- Log in

- E-Returns information filling

- Click returns menu and select File Nil Returns

- Key in all the required details on the nil tax return form

Type: Self

Taxpayer Pin: Is your Pin

Tax Obligation: Income tax Resident

- Giving more information

- Fill in your KRA Pin (Personal identification number)

- Fill in the wife details; if you don’t have that’s fine. Leave the column blank.

- Fill in the KRA Return period

- Click ‘submit’

- Create the Returns Receipt

-

- This is the final step

- You will receive a notification that your returns have been submitted effectively

- Download your Return Receipt and keep it for the record

How to File Returns Using P9 Form.

For employees of organizations and government, for you to file your tax returns, you need a P9 Form from the HR department. Others can get these forms from their bosses.

For teachers, download your P9 from the TSC site.

Often, the P9 form is completed by your manager and indicates your gross earnings, non-cash advantages, deductions, and annuity contributions. It also shows the sum of charge dispatched to the KRA during the previous year.

The following is the process on how to file KRA returns using your P9 form.

- Log into your iTax account

- Tap on Returns and pick ITR for Employment Only

- Enter the year and select Yes, then click NEXT

- On the Next Page, enter the Data Recorded in your P9 form i.e.

Amount of Tax Deducted = Total Tax

Defined Contribution=Total Retirement Contribution e.g. NSSF

Enter Personal Relief Total as shown on your form

- Save and Submit. If you did everything right, you should receive an onscreen notice indicating successful submission.

- Keep in mind that filing KRA returns for the last year 2018 ends this June 30, 2019. You should have filed your Tax returns to avoid penalties.

What is the Penalty for Late Tax Returns Filing?

As said, it is important that you file your tax returns earlier before the 30th June Deadline. Failure to do this, you will be exposing yourself to another burden, even after paying taxes – to pay a penalty of Ksh.20,000 per that year.

Or this can be 5% of the tax due. Whichever is higher between those two.

With that said, it means that if you have never filed your returns since the Law was passed in 2015, you owe the Taxman the fines for 2015, 2016, 2017 and 2018. Whether you were employed or not during that period – as long as you are registered with KRA and have been provided with a PIN.

When you calculate those penalties for cumulative years until today, you will notice you owe KRA over Ksh.50,000. So the more you don’t submit your returns, the more the sum keep growing.

How To File Tax Returns For An Individual With Employment Income Only.

How To File Tax Returns For An Individual With Employment Income Using The Excel Return.

How to File Tax Returns if you have a Withholding Certificate

How To File Your Tax Returns If You For Other Types Of Income Apart From Employment.

How to File VAT Returns on iTax Kenya If You’re Registered for VAT.

If you aren’t aware of what VAT or value-added tax is, this is the tax charged on supply of taxable goods and services whether made in Kenya or have been imported into the country.

VAT returns are supposed to be submitted online KRA portal on a monthly basis. The due date for the submission of these VAT returns is before or on the 20th of the following month.

In that respect, if you don’t have VAT, you are REQUIRED to submit a NIL return.

Here is the process of filing VAT returns:

Step 1:

- Go to the iTax site itax.kra.go.ke and login your details

- Download the VAT excel sheet

- Click on the Returns Menu>>File Returns>>Value Added Tax>>Download File

- Select the applicable KRA online tax returns forms

Step 2:

- Fill out the elements of the excel sheet and create an output which is a compressed document

- Use your month to month Z report and cost sheet to round out all the significant tabs on the VAT spreadsheet.

- You should round out these tabs accurately

- Validate the spreadsheet after you’re done. Validation helps to locate any blunders and if everything is okay, it will provoke you to produce a compressed record which you will transfer onto iTax.

- Save the zip folder carefully for ease of access.

Step 3:

- This step involves uploading the zipped document onto iTax.

- Go to iTax KRA login using your organization security accreditation.

- Click the Returns Menu

- Select file Return from the drop-down menu

- Tap on the drop-down menu on the ‘e-returns page’ and select ‘value-added tax (VAT) as your ‘Tax Obligation’.

- Ensure to fill the blank spaces for your VAT

- Write the KRA return period. The system auto-fills To Period once you input the Return Period From

- Click upload and upload your compressed file. Check by “Tick”, all the terms and conditions

- Submit

Step 4:

- Here, you need to generate a payment slip for the VAT you submitted.

- Click the Payments Menu and select Payment Registration.

- Continue to round out the spaces on the ‘e-payment Registration Form’

- Affirm that the liability sum under the ‘Liability Details’ is what you will pay.

- Select the Radio Button and tap the ‘ADD’ Button. This step adds the liability details to the Payment Details. Giving you the actual aggregate amount that you are required to pay.

- Then choose the Method of Payment; Check, cash or RTGS.

- Select the Receiving Bank Name i.e. the bank from which you are drawing the installment. This could be your organization’s bank account.

- Then tap the Submit Button

Step 5:

- Here, the process involves paying the VAT liability at your nearby bank.

- Print the Payment Slip in 2 duplicates. Take them both to your nearby bank with a check for the total sum submitted.

- The duplicates will be stamped. One will be retained by the bank and the other one given back to you for record keeping and future reference.

- Again, you will be sent an affirmation email by iTax acknowledging the payments you made.

- To confirm receipt, simply check your General Ledger on iTax

Frequently Asked Questions.

How Do I apply for TCC/Tax Compliance Certificate in iTax?

You can go to your iTax profile and apply from there. A KRA officer will receive the request and process the certificate electronically.

For successful applicants, you will receive an email with the TCC attached on it. But if your application was unsuccessful, probably there were areas of non-compliance which be highlighted for you to be aware.

Can I file all returns on iTax?

Yes, you can do. After logging into iTax, go to the Returns Tab and select File Return and download the Return.

You need to fill the Return offline before you generate a zipped file which you will upload.

Is it possible to correct an error made while filing a return?

Yes. You can definitely do this by filing an amended return

What do I do when I am trying to upload a return and get Pin X is invalid and yet it’s valid when running on PIN checker?

There is no much you can do. Call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office for assistance.

In Conclusion:

Considering the daring penalties attached to late or non-filing of tax returns, no one needs to remind you to learn how to file KRA returns. The least option available, take your forms to someone who knows how to do this and pay them for the service.

You have a whole year to submit your returns. Don’t wait when June 30 is just around and crowd yourself in a cyber café.

You don’t want to pay hefty penalties. Yet either you don’t earn anything or you paid the tax and still, you’ll pay a fine for paying your taxes – how painful!

Also Read: