Hustler Fund hit headlines long before its launch on November 30, 2022. And it has quickly escalated to become an integral financing scheme in the country, so much so that it’s now one of the major services offered by Airtel, Telkom, and Safaricom. But how do you apply for Hustler Fund in Kenya?

You can apply for Hustler Fund in Kenya by dialing *254#. Follow the prompts that appear on the screen, and then wait for a confirmation message to your application. You can also access Hustler Fund via the M-pesa app if you’re an existing Safaricom customer.

There’s more to learn about the Hustler Fund in Kenya than just applying for it. So continue reading this guide to learn more about the program before you apply.

What is Hustler Fund?

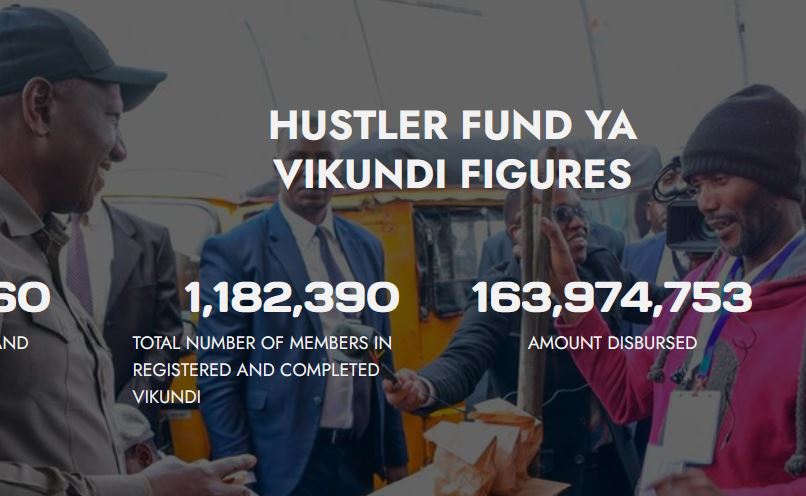

Hustler Fund, (with the slogan Jiinue, Jiendeleze), is a small loaning scheme launched on November 30th, 2022 by the Kenyan President, Dr. William Samoei Ruto.

The Kenya Government finances this program with a startup capital of Ksh. 50 Billion.

One of the major objectives of this loaning scheme is to ensure everyone accesses loans. And, in president’s own words, everyone in this context includes those that have been far behind for way too long, aka mama mboga, as far as loans are concerned.

Hustler Fund offers the lowest interest on loans, making it the first loaning platform to charge an 8% interest on loans in Kenya.

The fun fact about the Hustler Fund program is how fast it grabbed attention. In fact, Hustler Fund disbursed over Ksh. 408 million to people across the country within the first 12 hours of launch.

Hustler Fund allows you to make partial payments to reduce your debt in no time, no matter the amount loaned.

The only thing you’ll perhaps not like about the program is the time it takes to get an approval. You may have to wait for 30 minutes to 2 hours to get a notification message on the status of your participation in the program.

How to Apply for Hustler Fund in Kenya

To get the Hustler Fund, you will need to register yourself as a member of the program. Here’s what you need to do:

- Step 1: Dial *254# on your phone.

- Step 2: Choose the Register option and send your request.

- Step 3: Select the Accept Hustler Fund terms and conditions option.

- Step 4: Next, confirm that you own the account by providing your mobile money PIN.

- Step 5: Wait for a confirmation message to your Hustler Fund registration, which will also include the starting limit that you’re eligible to borrow.

- Step 6: Dial the code once and request your available Hustler Fund loan limit.

Hustler Fund Requirements (Terms and Conditions of Service)

First, you must be a Kenyan citizen, over the age of 18, and with a valid national identification card to participate in the Hustler Fund program.

Second, your SIM card must have been active for at least 3 months (90 days) on Airtel, Safaricom, or Telkom network.

Hustler Fund also include terms and conditions of their service to all the 3 mostly used communication networks in Kenya.

I strongly recommend that you read these terms and conditions before you make the decision of signing up for the program.

Minimum and Maximum Amount You Can Loan from Hustler Fund

The minimum amount you can borrow from the Hustler Fund program is Ksh. 500 and the maximum is Ksh. 50,000.

To be clear, you don’t decide what your starting limit is; the system does it for you. The Ksh. 500 cap is the lowest limit I’ve seen, and that grows a long as you make your repayments on time to maintain a good credit score.

Every Kenyan needs to understand that the only way they can improve and increase their credit score for Hustler Fun is by paying the loan on time.

To be clear, we have seen some people going to the extent of impersonating the H.E. just to assure lenders their loan limits can go higher, fast. Online fraudsters are already preying and taking advantage of people desperate to increase their Hustler Fund limit.

You need to exercise caution and ignore such claims. Where mandatory, avoid or block anyone claiming to have the technology that increases Hustler Fund, be it on Facebook, Instagram, or Telegram.

There is no point in losing your money to thugs online at a time when every penny matters to start your long-desired business.

Since there is no way you can have your Hustler Fund loan limit increased instantly, it would be better to start with the least amount offered and improve your credit score and borrowing limits by repaying your loans on time.

Is there a Hustler Fund App?

There is NO such thing as Hustler Fund app in existence – at least not at the moment.

As much as some may be looking for the app to make Hustler Fund loan requests and repayments easy, we advise you to stick to the USD code because there is no app specifically dedicated to this service.

I’m aware that some creative mobile app developers have gone as far as to create an app called Hustler Fund. And the target is the young desperate Kenyans who perhaps wish they could get more money from the program.

DO NOT install or use the app. It’s a fraud scheme that doesn’t have any resemblance or affiliation with the real Hustler Fund program.

Stick to the *254# USSD code.

Frequently Asked Questions

1. What is Hustler Fund Interest Rate?

Hustler Fund is currently the money-lending program that offers the lowest interest on loans in Kenya. You pay back the money you borrowed with only an 8% interest.

If you borrowed Ksh 500, for example, you will pay back Ksh 500 + 8% of Ksh 500, which is Ksh. 540.

2. What is the Repayment Period for the Hustler Fund?

The Hustler Fund program expects those who have acquired a loan to repay back the loan plus the interest within 14 days from the date of disbursement.

Final Thoughts

Any person who opts for a Hustler Fund loan should not have the fear of exploitation by exploitative leaders.

In addition, Hustler Fund will provide affordable credit to four major areas including personal finance, SME loans, microloans, and startup loans.