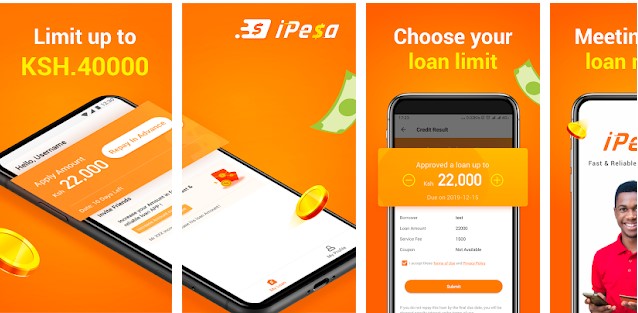

The Kenyan mobile borrowing market is at its peak, and it’s crazy considering the number of loan apps in existence and how often people borrow using them. One of those apps is the iPesa loan app.

Promising a loan repayment tenure of 91-18 days and loans from Ksh 500 to Ksh 5,000, depending on eligibility, iPesa is increasingly warming its way into the hearts of ever-borrowing Kenyans.

Owned by Chinese billionaire Junjie Zhou, iPesa mobile app, like many others, comes in handy in financial emergencies, but it could also be your ticket to CRB-blacklisting if you don’t pay up.

This post will look at everything you need to know about iPesa, including downloading information, eligibility requirements, application, repayments, and limits.

Why You Should Use the iPesa Loan App

According to iPesa, here are the advantages that come with using the mobile lending app:

- No extra hidden charges

- You do not need collateral to apply for a loan

- Protection of personal data

- Quick loan disbursement to your MPESA

- Better higher limit once you repay your loan in time

- Great customer support

Requirements for Downloading The iPesa App

Before you can download the iPesa App and start borrowing, you should ensure you meet these basic conditions:

- Have a registered Safaricom line with an active MPESA account

- Possess an internet-enabled android phone

- Be at least 18 years+ and with an ID

iPesa Loan App Download and Account Registration

Sadly, for iPhone users, iPesa is only available on Android. If you have an Android phone, follow these steps to download iPesa and register for a borrower’s account:

- Go to Google Play and search for iPesa and download it

- Launch the App on your smartphone

- Select new registration

- iPesa will request access to your SMS and contact information, which you have to accept to be eligible for a loan

- Wait for a verification SMS code to continue with the application

- Set a four-digit password and then confirm it

- Accept the terms, conditions, iPesa policy, and regulations, and that’s it.

How to Apply iPesa Loan

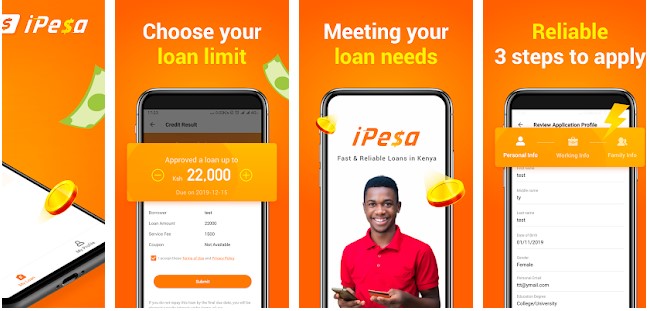

Before you can apply for an iPesa loan, you will need to fill a form, which comes in 3 main parts as follows:

- Personal Information

This is where you enter your names as they appear on your ID, your date of birth (DOT), gender, ID number, location, email address, and education level.

- Work Information

iPesa will need you to provide information on your working status. That is, you have to mention if you are employed, self-employed or just a student. If employed, you’ll need to indicate your monthly pay and payday or salary frequency.

- Family information

This is the last step for the registration and often the deal-breaker for most mobile apps. iPesa expects you to provide emergency contacts for at least two people, mostly family. You need to provide their names, phone numbers and mention your relationship.

The problem with this move is that if you default to pay, iPesa won’t stop texting and sometimes calling your contacts, asking them to ask you to pay up. It is not very pleasant, I must say!

Once iPesa confirms your details, they’ll provide you with a loan limit to which you can apply.

iPesa Loan Limit

Well, iPesa allows you to borrow a minimum of Ksh 500 to a maximum of Ksh 50,000. However, you should note that for you to qualify for a higher loan limit, you have to do the following:

- Pay the loan back on time – According to iPesa, the quicker you pay back the loan, the likelier you will get a higher limit.

- Transact more with MPESA – Since iPesa checks your MPESA messages, the more you transact using your MPESA, the higher your chances of increasing your loan limit

- Stay away from CRB – Though iPesa does not bar you from borrowing from other lenders, you should avoid getting blacklisted by them. If you do, you will not only qualify for a higher limit, but you may also fail to get another loan from iPesa again.

How to Pay iPesa Loan

Repaying your iPesa loan is easy. You will only need to follow these quick steps:

- Go to the MPESA app on your phone

- Select ‘Lipa na MPESA’

- Click on ‘Paybill’

- Enter the iPesa paybill number 192010

- Enter the account number (which is your mobile phone number)

- Put the amount you want to repay

- Press OK

- Enter your MPESA pin, confirm your details, and press OK

- Wait for iPesa and MPESA messages confirming that you have repaid your iPesa loan successfully

Please note that MPESA will charge you a transaction fee depending on the amount you are paying.

iPesa Loan Interest Rates

iPesa charges 15% for loans payable within 14 days. However, they have a standard charge of 12% APR on loans payable within 91-180 days.

iPesa Late Loan Repayment

If you apply iPesa loan successfully, you should pay before the due date. Failure to do so, iPesa will charge you additional interest of 2% of your loan amount per day.

For example, if you borrowed Ksh500, you will pay Ksh 10 every day on top of your total loan amount and interest.

Suppose you fail to repay your loan before the due date and ignore iPesa calls and SMS reminders?

In that case, iPesa can take your personal information to the Credit Reference Bureau (CRB), where you will be blacklisted from applying from other loan lenders in the future until you pay it back.

iPesa Rewards and Promotions

iPesa occasionally offers coupons to loyal customers (those who promptly pay their loans after borrowing), among other rewards.

You can follow them on Facebook (iPesaKenya) for more updates on their loan offers.

What Are the Disadvantages of iPesa?

Let’s face it; a 12-15% interest rate is slightly higher than what banks charge. And considering the late fees, things can get steep financially.

The other disadvantage and probably the most annoying is that iPesa can text or call your contacts, informing them of your inability to pay up. But if you are good with paying back loans, then this shouldn’t be a problem.

But again, some people complain that customer support calls them severally even before their loan due date, which can be annoying.

iPesa Contact Number

In case of challenges, inquiries or any concerns, you can reach out iPesa’s customer desk through any of these options:

Phone number: 0757222979

Landline: +05488888888

Email: service@iPesa.cc

FAQs

1. Where Can I Download the iPesa App?

Currently, iPesa is only available on the Android platform. You can download the App on Google Play.

2. How Do I Get a Loan with iPesa?

To get a loan with iPesa, you have first to download the App from Google Play, create an account, and then go through the terms and requirements.

Once you confirm your eligibility, fill in the application and wait for your loan to be processed.

3. How Do I Become Eligible for an iPesa Loan?

You become eligible for iPesa by first downloading the App from Google Play and signing up for an account. You’ll then need to provide personal and work information which iPesa uses to determine your eligibility for the loans,

Note that iPesa requests access to your messages and contacts as part of the requirements. So, ensure you don’t have texts showing payment defaults or complaints from other lenders, as that could lead to disqualification.

4. How Long Will I Wait for My Loan After Applying?

iPesa loan disburses the loan to your MPESA account in a few minutes after successful application. You will receive two messages from MPESA and iPesa, notifying you of your loan disbursement.

5. What Are iPesa Loan Interest Rates?

If you take a 14-day loan, iPesa will charge you 15% interest. But if you take an option that is repayable in 91-180 days, iPesa charges 12% APR.

However, if you fail to repay your loan on time, iPesa charges 2% of the loan amount per day on top of the regular interest.

6. Is My Personal Information Secure with iPesa?

iPesa encrypts your data and personal information from being accessed by third parties. iPesa promises not to disclose your information unless you fail to repay your loan, even after the constant reminders.

When you default on payment and fail to respond to the reminders, they may choose to share about your loan with your contacts or, in a worse case, forward your details to the Credit Reference Bureau (CRB).

7. Can iPesa Grant Request to Clear My Loan Later After Due date?

The simple answer is NO! Once you agree with iPesa that you will repay your loan within a given period of your choosing, that’s it! iPesa cannot grant later-date loan repayment requests. However, you will pay a penalty of 2% if you default on your loan repayment daily.

8. What Happens If I Overpay My Loan?

If you accidentally overpay your loan, you should contact the iPesa customer support team. You will then have to wait for 15 days for iPesa to deposit the extra funds back into your iPesa account.

9. What to Do If My Loan Payment Does Not Reflect?

If you repay your loan and do not receive a confirmation message from iPesa, you must contact iPesa customer care. They usually solve the issue in a few hours and inform you via SMS.

Relevant:

Closing Thought:

You now have everything you need to know about the iPesa loan app. If you wish to apply for the loan, go to Google Play on your Android phone, install the App, apply for the loan you want, and read the terms before accepting them.

Remember, the only way to avoid finding your name on CRB’s blacklist is to pay up on time. After all, a loan should be paid!