Mobile loan apps are undeniably a trend in Kenya as they are seen as a quick fix to financial emergencies. However, very few Kenyans are aware of loan apps without CRB check.

So, since we often find our names been listed by the credit reference sheriff, the CRB (credit reference bureau), we no longer bother with the apps.

The good news is that not every lender consults CRB. Some don’t bother with the credit reference Marshall, which means you can secure a mobile loan even with a poor credit score.

The only issue is that they charge higher interests than others and may require some extra personal information such as employment status, monthly income, and your Mpesa transactions before offering you a loan.

Most of them also charge a service fee for activating and managing your account. So, see it as using money to get more money. And I forget; after you get more money, you also pay more in interest.

I probably lost you there, but all I’m saying is that the interests are pretty steep!

Before we can look at these loan apps in detail, find below a table summary of their offers.

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

Best Loan Apps In Kenya Without CRB Check

| Loan App | Loan Duration | Service Fee | Yearly Interest Rate | Loan Amount |

| Opesa | 91 – 365 days | Ksh 100 – Ksh 600 | 36% | Ksh 2,000 – Ksh 50,000 |

| Okash | 91 – 365 days | Ksh 100 – Ksh 3,000 | 36% | Ksh 500 – Ksh 50,000 |

| Mokash | 91 – 365 days | No service fee | 36% | Ksh 2,000 – Ksh 10,000 |

| Usawa | 91 days – 36 months | Ksh 400 | 12% | Ksh 500 – Ksh 1,000,000 |

| Jazika | 61 – 180 days | 12% | 12% | Ksh 500 – Ksh 100,000 |

| Fadhili | 91 – 365 days | Ksh 400 | 24% | Ksh 500 – Ksh 1,000,000 |

| Utajiri | 91 – 365days | Ksh 250 | 12% | Ksh 300 – Ksh 300,000 |

| Tunzi | 90 – 365 days | Ksh 400 | 18% | Ksh 1,000 – Ksh 250,000 |

8 Best Loan Apps Without CRB Check

Below are eight best loan apps that lend money to their customers without checking their credit score:

1. Opesa Loan App

Opesa is one notable lender that offers unsecured loans without consulting the credit reference bureau. However, the lender will need access to your phone data like Mshwari and Mpesa transactions and phone identity.

Moreover, Opesa will require you to state the reason for applying for the loan.

Opesa short-term loans attract a 14% – 16% interest rate while you pay a 36% interest on long-term credit.

The loan limit is between Ksh 1,500 and Ksh 50,000, and once the loan is approved, you have 91-365 days to repay the loan entirely.

Note that Opesa requires you to pay Ksh 100 – Ksh 600 as a service fee, depending on how much you apply.

So, they deduct the service fee from the loan you qualify for and then disburse the rest into your MPESA. That means you’ll receive less than what you apply for.

Loan Application

Here are the steps to follow:

- Download Opesa mobile loan app from Google Play

- Install the app and register with your Safaricom number

- Then apply for the loan you qualify

- Wait for the loan approval and disbursal into your MPESA

2. Okash Loan App

Okash, managed by OneSpot Technology, gives loans without collateral or credit check. But for you to qualify for an Okash loan, you must be 21 – 55 years old. Additionally, you should have a steady income and a Safaricom registered line.

Okash charges a 14% – 16.8% interest rate on their short-term loans and 36% on their long-term loans.

The loan limit is Ksh 500 – Ksh 50,000, payable within 91 – 365 days of borrowing. Ksh 100 – Ksh 3,000, however, is deductible from the amount you qualify for to act as the activation fee. The fee depends on how much you apply for.

Loan Application

Here’s how to apply for an Okash mobile loan:

- Download the loan app from the Google Play

- Verify your number and check the amount you qualify

- Choose the loan duration and apply

- Wait to receive the loan on your Mpesa line after approval, which takes minutes

3. Mokash Loan App

Mokash is also offering loans without checking with the credit reference bureau. And unlike most loan apps in this list, Mokash doesn’t charge a service fee.

So, it’s one of the best loan apps without CRB check and registration fee. You, however, need to be at least 20 years to qualify for a Mokash loan.

Okash loans attract an annual interest rate of 36% for Ksh 2,000 – Ksh 10,000 loans. All loans are payable between 91 – 365 days.

Loan Application

Here are the steps of securing a mobile loan from Mokash:

- Download Mokash from Google Play and launch it on your phone

- Grant the app permission to your phone and agree to its terms

- Set a password and wait for the app to display the loan amount that you qualify

- Apply for the loan and wait for the disbursement, which takes a few minutes

4. Usawa Loan App

Usawa, a Swahili name for equality, lives up to its title by promising unsecured emergency loans to everyone regardless of their CRB status. You, however, must have an ID and own a smartphone.

The app collects data from your phone to determine the amount you qualify for. But overall, Usawa offers Ksh 500 – Ksh 1,000,000, payable within 91 days and 36 months.

Usawa charges a 12% interest rate on their short-term and long-term loans. But first, you need to pay an upfront service fee of Ksh 400 to activate your Usawa account.

Loan Application

Here are the steps for securing a mobile loan from Usawa:

- Download Usawa mobile app from their website

- Create an account by filling in all the necessary information

- Pay Ksh 400 for your account to be active

- Apply for the loan amount you need, and wait for approval

5. Jazika Loan App

Jazika loan app is a product by Jazika Ventures who promise instant loans to Mpesa without a CRB check.

If you are looking for a loan to grow your small business or settle an emergency, Jazika makes that possible. However, you will have to pay a 12% one-time service fee before you can get a loan.

The loan amount range is Ksh 500 – Ksh 100,000, payable in 61 – 180 days with an annual interest rate of 12%.

Loan Application

Here are the steps for obtaining a loan from Jazika:

- Download the Jazika loan app from Google Play

- Create your account with personal details

- Enter the loan amount and pick the repayment period

- Complete the loan application and submit the details

- Wait for the loan approval and disbursement, which takes a few minutes

More Mobile Loan Apps Without CRB Check

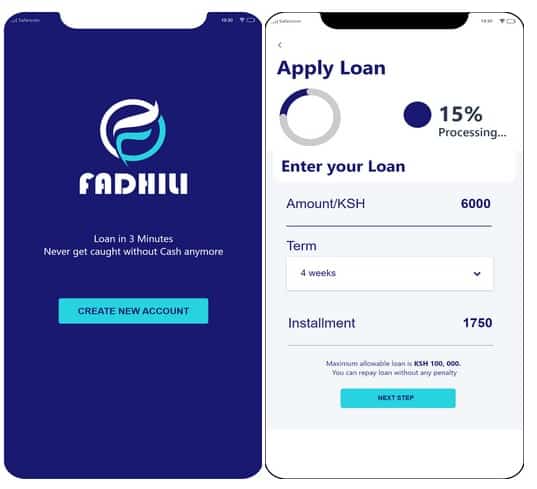

6. Fadhili Loan App

Fadhili, a product by Mkopo Kenya, gives loans with zero paperwork and no CRB check to its customers nationwide. They, however, charge an upfront service fee of Ksh 400.

Fadhili loans start from Ksh 500 to Ksh 1,000,000 and are payable within 91 days – 36 months. The annual interest rate is 21%.

Loan Application

Here’s how to apply for a Fadhili loan:

- Download the Fadhili loan app from their website

- Fill all the required fields and confirm your Safaricom mobile line

- Activate your Fadhili account by depositing Ksh 400 to pay bill number 995321

- Select the loan amount you want to apply and the repayment period

- Fadhili will then request you to provide a referee and then submit your loan request

- After successful evaluation, Fadhili will disburse the loan to your Mpesa account within 3 minutes

7. Utajiri Loan App

A product by Utajiri Mobile, the Utajiri loan app, offers Ksh 300 – Ksh 300,000 without a credit check. Overall, Utajiri loans are payable within 91 days – 365 days, attracting an annual interest of 12%.

However, for your account to be active, you need to pay an upfront service fee of Ksh 250.

Loan Application

Here’s how to apply for a loan from Utajiri:

- Download the Utajiri loan app from their website

- Create an account by filling the questionnaire with your details

- Pay Ksh 250 service fee to pay bill number 877199

- Apply for the loan and wait for disbursement that takes a few minutes

8. Tunzi Capital

Tunzi Capital gives Ksh 1,000 to Ksh 250,000 without a credit check and the repayment period is between 90 days and 48 months.

The short-term loans accumulate 15% interest while the yearly loans incur 18% interest. You, however, pay a service fee of Ksh 400 – Ksh 1,000, depending on your loan amount.

Loan Application

Here’s how to apply for Tunzi loans without CRB in Kenya:

- Download Tunzi Capital from Google Play

- Fill the questionnaire to create an account

- Activate your account by paying Ksh 400 to pay bill number 800950

- Check the loan limit you qualify and submit your request

- After approval, Tunzi deposits the loan to your Mpesa account within a few minutes

How Do I Know If I Am Blacklisted by A CRB Check?

You can check your credit score from CRB in two ways:

Method 1 – Using USSD

- Dial *433# on your mobile

- Key in your ID number

- Create a 4-digit password

- Confirm your details and wait to receive a message confirming your CRB status

Method 2 – Using App

- Download Metropol app

- Enter and send the required details

- Wait to receive a message on your credit score

Note that you will have to pay Ksh 100 to pay bill number 220388 to receive the service.

People Also Ask (About Loan Apps without CRB in Kenya)

1. Can You Get a Loan If You Are Blacklisted in Kenya?

Some lenders in Kenya offer you unsecured loans without CRB checks. They, however, expect you to pay a certain amount upfront, which they call activation/service fee and take personal and employment details before granting you the loan.

2. How Can I Clear My Name from CRB?

Consider downloading the Metropol app and using it to check the lender that blacklisted you.

You’ll then need to contact the lender and negotiate how to pay your loan before they can clear you from the CRB.

3. Can Loan Apps Put You in CRB?

Sadly, most Kenyans end up on CRB’s blacklist because mobile money apps forwarded their details. So, it’s essential that you pay up to avoid blacklisting.

Also Read:

Emergency Loans in Kenya Via MPESA

Closing Remarks on Loan Apps Without CRB Check

While the above mobile apps promise to offer unsecured loans without consulting the credit reference bureau, they charge an activation fee upfront and have steeper rates. So, that’s something you should keep at the back of your mind when downloading the app.