We Kenyans in the online working space recognize the importance of a convenient mode of online payment, and that’s where PayPal comes in. We also want the funds on our mobile phone, and nothing fits the bill more than MPESA. But now, there is PayPal MPESA, which brings both worlds together.

Through PayPal-MPESA, it’s now easier and faster to transfer money between PayPal and MPESA, which means your online client from the UK, US, Australia, South Africa, and other countries can pay you just by setting up a quick PayPal account. You’ll, in turn, do the M-PESA transfer later or as soon as the money hits your PayPal account.

Remember, you also can send money to PayPal from MPESA, which means it’s two ways.

This guide will help you set up a PayPal account, link it to your MPESA, and use it to send or receive money from MPESA. I’ll also highlight the transactional charges, limits, and challenges with PayPal MPESA transactions.

But first, let’s look at how the PayPal M-PESA payment model works:

GIFT!– Get a Free Personal Finance Guide from our friend centwarrior.com. Cent Warrior is a tribe of non-conforming financial warriors promoting a generation that’s financially free and debt free. They have developed a wonderful free personal finance guide (Click Link to download) that you’ll find helpful in planning your finances and avoiding debt in general. We really hope that you’ll find it worthwhile to start building a solid foundation towards your financial freedom. Check them out here on social media.

How Does PayPal to MPESA Work?

PayPal-MPESA is a money transfer service offered by global online payment facilitator PayPal and Kenyan mobile money giant Safaricom.

The service allows registered M-PESA users with registered PayPal accounts to link the two and use their accounts to send or receive money across.

You can deposit money into your M-PESA account and send it to PayPal to pay a bill or make the payment or withdraw money from PayPal to M-PESA, as is often the case for freelancers like myself.

So, the PayPal and MPESA collaboration doesn’t just benefit freelancers who are making money online in Kenya but also clients and online shoppers.

On the one hand, freelancers have a convenient way to receive money from anywhere globally through PayPal and transfer it directly to their M-PESA. After that, they can choose to bank it, withdraw it, or pay a bill.

On the other hand, Kenyan clients can hire experts globally and pay them via PayPal. That makes it easy for Kenyan companies to outsource experts without worrying about how they’ll pay them.

To facilitate the transaction, they need to load their PayPal accounts with funds from their M-PESA wallet. The same goes for online shoppers in Kenya who prefer to shop for products outside Kenya.

How to Link PayPal with MPESA

Before you can transfer money from PayPal to M-PESA and vice versa, you must link the two accounts. First, you must have both accounts set up.

If you don’t have a PayPal account, click here to sign up for one. It takes seconds to do it. Once you have a PayPal and M-PESA account set up, you should link them using these steps:

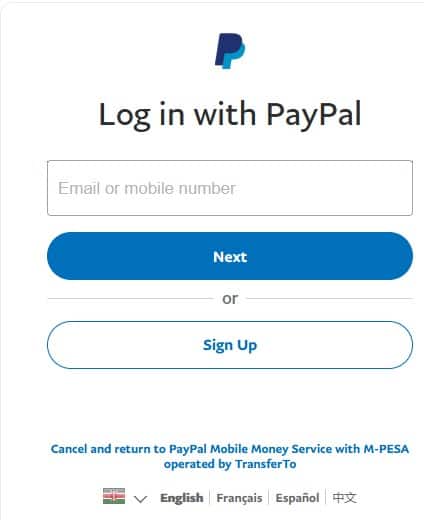

- Visit https://www.paypal-mobilemoney.com/m-pesa to access the PayPal MPESA login page

- Log in to your online PayPal account using your PayPal email address and password

- Agree to the terms and conditions of the service

- Locate the ‘add M-PESA number’ option and click on it to link your PayPal account with your M-PESA line

- Enter your MPESA mobile number and wait to receive a 4-digit code

- Use the code to verify your account and complete the MPESA-PayPal linking.

Once you link up your PayPal and MPESA accounts, you can transfer money from either account from the comfort of your home or workspace.

How to Withdraw Money from PayPal to MPESA

Now that you’ve linked PayPal to M-PESA, you can receive payment via PayPal and transfer the funds to your M-PESA fast and conveniently.

Here’s how to withdraw from PayPal to M-PESA:

- Login in to your PayPal-MPESA account

- Choose ‘withdraw from PayPal’ and wait to see the balance (in dollars) you wish to withdraw, and then click withdraw.

- You’ll then be directed to a new page showing the exchange rates for the currency conversion and an estimate of the processing time.

- Once you are okay with the rates, click confirm to complete the withdrawal.

Remember, the maximum you can withdraw from PayPal per day is Ksh 150,000. However, you cannot do above Ksh 70,000 per transaction.

How to Send Money from MPESA to PayPal

You can also load funds into your M-PESA line and transfer them to your PayPal account to make a payment. Here’s how to go about it:

- Visit the PayPal-MPESA login page to log into your account to access the currency converter. Use it to determine how much you should load into your PayPal account from M-PESA, depending on the payment you want to make

- Now, take your phone and go to Lipa Na MPESA

- Use the pay bill number 800088

- Input your phone number under the account number

- Enter the amount you want to load into PayPal in Kenya shillings

- Input your MPESA pin and click send

It usually takes up to 2 hours to top up PayPal from M-PESA, but in most cases, it takes minutes. You’ll receive a confirmation message once the transaction succeeds.

PayPal to MPESA Charges

Here are the latest MPESA-PayPal charges for withdrawals and topping up:

- Withdrawal charges – 3% of the withdrawn amount (what you are sending from PayPal to M-PESA)

- Top-up charges – 4% of the top-up amount (what you are sending to PayPal from M-PESA)

Note that standard MPESA transaction charges affect other transactions.

Processing Time

Ordinarily, it takes up to 2 hours to process money from M-PESA to PayPal and vice versa. Sometimes it takes minutes, and in some rare cases, it may take up to three days if there are issues or it’s a high-value transaction.

PayPal to MPESA Withdrawal Limits

As good as the PayPal-MPESA partnership is, there are limits to withdrawing funds from PayPal to M-PESA. Currently, the maximum you can withdraw per transaction is Ksh 70,000, and the most you can do per day is Ksh 150,000. Overall, this can be displeasing if you’ve more money and want it immediately.

How to Unlink PayPal from MPESA

Unfortunately, there is no systematic process for unlinking your PayPal account from M-PESA. However, you can do it by contacting Thunes explaining what you want to do. From what I’ve gathered, this approach is effective.

PayPal MPESA Challenges

PayPal-MPESA is a problem-solver for most people as it allows them to transfer funds between the two services conveniently. That, however, doesn’t mean that it’s perfect, as it has a few challenges that infuriate most users, including me.

These challenges include:

1. Payment Holds

Nothing annoys you like withdrawing money from PayPal to your M-PESA only for it to be held for days (up to three days). That’s very frustrating.

It doesn’t happen often, but it can happen, and the best you can do is contact PayPal and explain your challenge.

The good thing is that they always respond and will explain what you must do to release your funds.

2. Withdrawal Limits

You can only withdraw a maximum of Ksh 150,000 per day or Ksh 70,000 per transaction. That can be infuriating if you were expecting to make a massive withdrawal for whatever reason.

3. Accounts Hold

If you think a payment hold is annoying, wait till PayPal puts your account on hold, informing you that you have to wait for 180 days. That’s six months, by the way!

So, what will you do for six months when you cannot access the funds? Now you get it! That’s where the frustration comes in.

The good news is that it doesn’t happen to everyone but those with unverified PayPal accounts who’ve exceeded their annual limits.

Overall, you need to upload your ID, a recent bill, and a bank statement to verify your account, which you should do as soon as PayPal informs you. That will save you from the frustration of an account hold.

4. High Fees

Not only does PayPal take its cut from transfers but also does M-PESA. That’s often annoying, especially when the MPESA charges keep changing.

People Also Ask

1. Is PayPal Linked to MPESA?

Yes, PayPal is linked to M-PESA to allow you to transfer money between the two platforms. But first, you must have a verified M-PESA and PayPal account which you can link online using this link.

2. Can PayPal Send Money to MPESA?

Nowadays, you can send money from your PayPal account to M-PESA by logging into the PayPal-mobile money page and clicking on withdrawing. The page allows you access to your PayPal balance, and you can withdraw whatever amount you want to your MPESA.

3. How Long Does It Take to Transfer Money from MPESA to PayPal?

In most cases, it takes 2-3 minutes to 2 hours to receive money in your PayPal account from M-PESA. However, it may take up to 3 days if it’s a high-value transaction or issues with your account that need verification.

4. Why Can’t I Withdraw Money from PayPal to MPESA?

You cannot withdraw money from PayPal to M-PESA because your two accounts are not matching. It could be a mix-up in the names. For easy MPESA linking, ensure they appear as they do on your ID when setting up your PayPal account.

5. How Do I Send Money from PayPal to MPESA?

You can send money from PayPal to M-PESA by login into the PayPal-mobile money page to access the withdrawal function. Once you click on it, you can withdraw any amount into your MPESA.

6. Can You Use MPESA to PayPal?

You can top up your PayPal account using your M-PESA wallet to facilitate online payment. You need to use the Lipa Na MPESA pay bill number 800088to make the transfer from your M-PESA line to your PayPal account.

7. What Is the Minimum Amount to Deposit to PayPal from MPESA?

As long as you pay for the transaction charge, you can deposit any amount to PayPal from M-PESA. So, it generally depends on how much money you’ve in your MPESA wallet, but you cannot exceed the normal MPESA transaction limits of Ksh 150,000.

Closing Thought:

Above is everything you need to know about PayPal MPESA. Whether you want to make payments outside Kenya or Withdraw funds from PayPal to M-PESA, the PayPal-MPESA partnership makes it possible.

Hopefully, the above guide will help you have an easy run when transferring cash between the two platforms.